When it comes to savings apps, coupons and bargain hunting, I could go on and on for days. It’s been both a necessity and a passion in my life. I live in Nashville, which is quickly becoming among the most expensive places to live. Therefore, it is simply silly and impractical to not save money when I very well know that I can. However, prior to the rising cost of living, I was always a saver. It never will matter if I’m rich or poor. I will always use my coupons, apps and savings opportunities, because why not? My mom taught me how to be a saver from an early age. I honestly believe my mom’s early teaching has made me a more thankful person in the long run.

I have always enjoyed looking at my savings on any given trip, and always vow that some year I’m going to keep track of my total savings, because it has to be thousands of dollars. However, this kind of record-keeping requires A LOT of dedication.

Still, whether it has been shopping for clothing, planning my wedding, or looking to redecorate my home, I have always been dedicated to being thrifty and frugal…..(even if it takes me a little bit of extra time). I will never be the girl to just drop $50 on a shirt, nor will I ever be the one to pay regular price on anything when it isn’t necessary. If it’s already only $7.99 at Ross or $8.99 at Marshall’s, I can certainly pay regular price then. In that case, I’m at a discount store to begin with. I just cannot justify paying for one shirt what I very well know I can get four shirts for. Catch my drift?

I often get asked about my savings: What I do, and how I do it?

Whether or not I’m asked, I always enjoy sharing my tips with anyone and everyone. My endless tips and tricks would be best spread out over a series of posts. However, today, I am just going to educate my frugal friends on the savings apps I’ve been using. Have a smart phone? GREAT! Do you save receipts? PERFECT! Put them to great use! Even if it’s a gas station receipt for a pack of gum, tell the cashier you want your receipt when he/she asks.

Now……download the following FREE apps for opportunities to earn cash back, e-gift cards and free items.

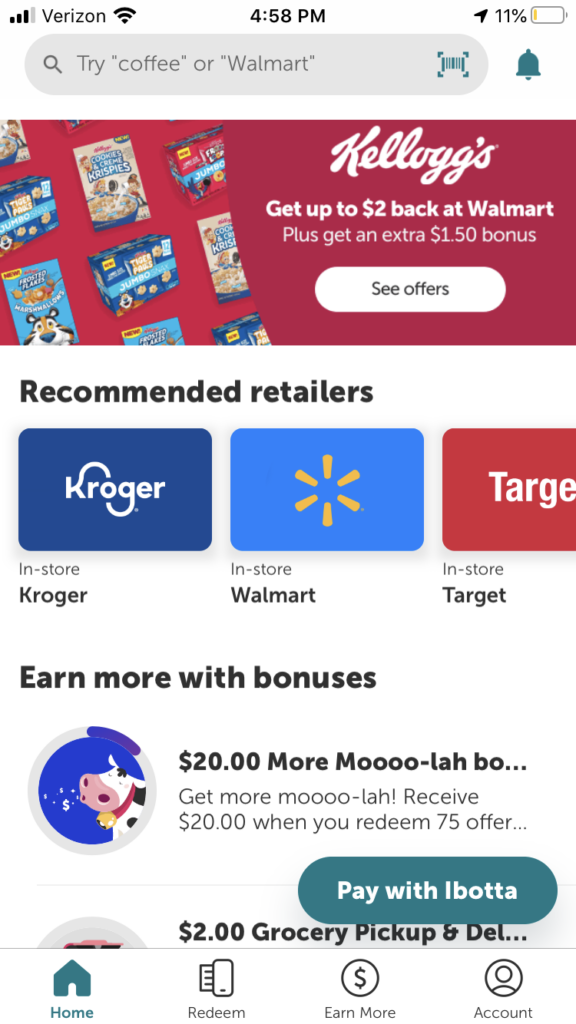

- Ibotta: This is probably among the most popular of savings apps, so I’m going to go ahead and assume that many of my readers probably already know about this one. However, I meet people all the time who haven’t yet discovered it. In fact, I didn’t sign up with Ibotta until 2 years ago, though I’m pretty sure I had heard about it prior to then. I don’t think I realized how easy or beneficial it was until I really gave it a chance. (To date, I have earned $482.48 in cash back in 2 short years on this app alone).

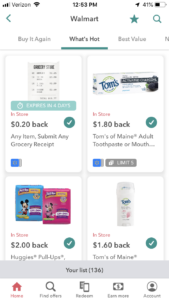

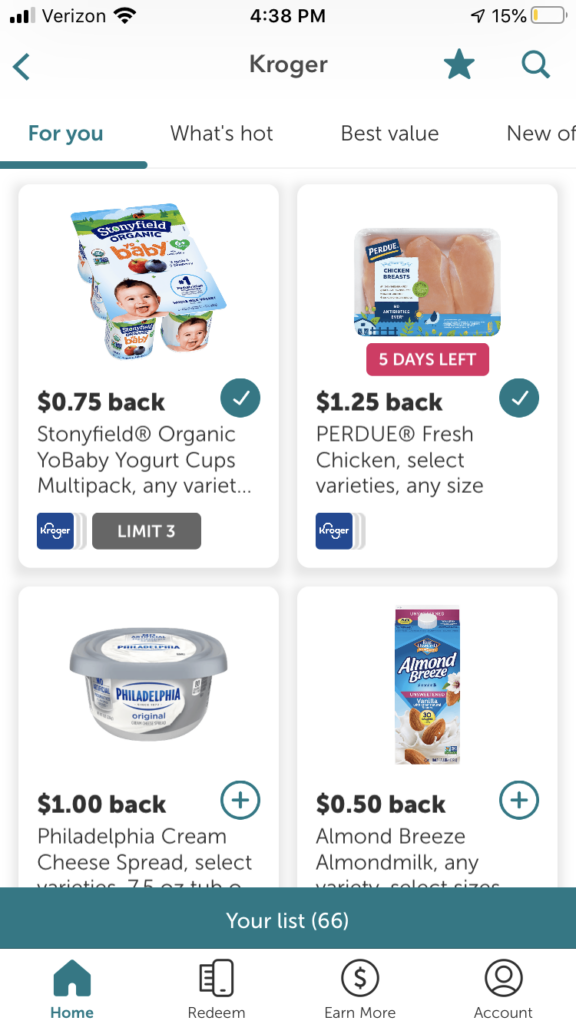

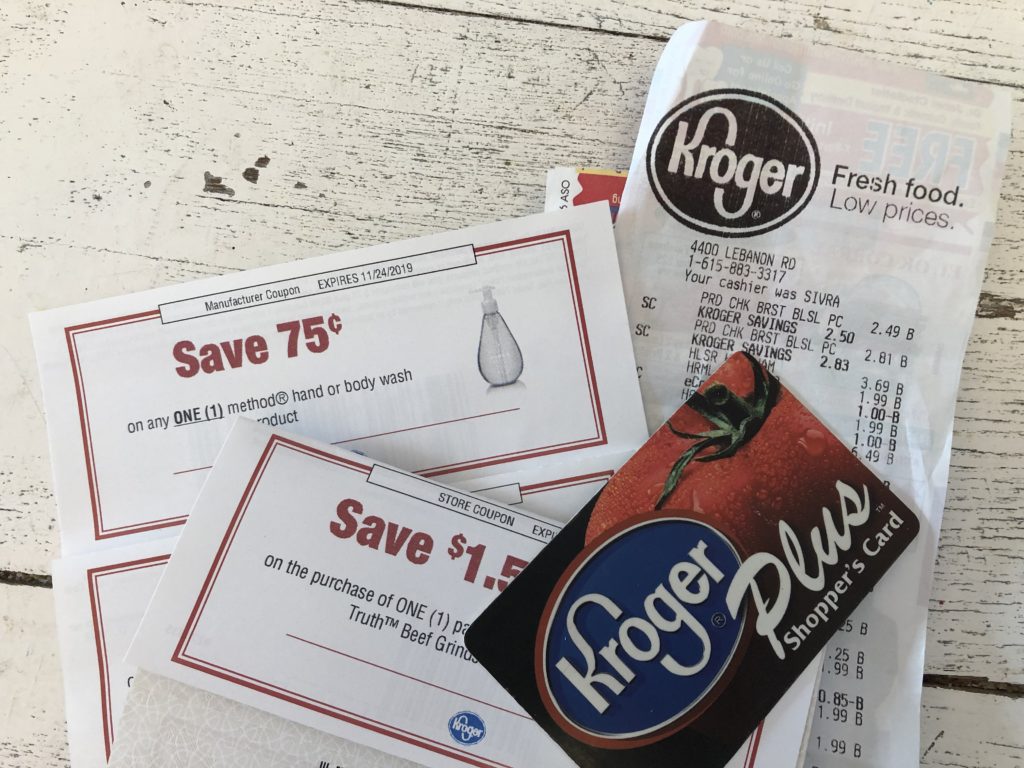

How to use: Basically, on this app, you search for offers that are available at different stores you shop at or plan to shop at. Some of my main stores would be Kroger, Wal-Mart, Publix, Walgreens, Target and Amazon, for example. They also feature other random stops like certain gas stations and even the Dollar Tree. You simply click on the + signs of the items you may be interested in purchasing at each store.

Then, you go shopping and actually buy the participating items. (REMEMBER to get your receipt….and do not lose it! This will not work without your receipt).

Next, you will want to redeem your offers once you get home. Now, let me first say: If you used Ibotta for Wal-Mart, this next step is going to be extra easy, as long as you have hit the + symbol on all your items. With Wal-Mart, all you have to do is generally scan the little square box at the bottom of your receipt, and it will almost ALWAYS automatically detect all participating items you added to your list.

Kroger and most other stores though? You will likely have to scan the UPC on each product. I tried linking my Kroger card to the app, but for whatever reason had issues. Maybe you will have more luck than I did.

There are many opportunities items in which you can purchase the same item multiple times and get cash back for each one – you simply put in the quantity (but Wal-Mart even detects your quantity). Some items, they will require you buy 2 or more to get cash back, so make sure you look closely.

I have come to find that Wal-Mart is the most user-friendly with Ibotta and offers the most, though I’m not a big Wal-Mart shopper. I use it at multiple retailers, though I am a pretty devoted Kroger shopper.

What’s more? You can also get this cash back in addition to the sales and your usual coupons.

For example, let’s just say I purchased the limit of 5 Fage yogurts for .50 cents back on each. I will scan my receipt, scan each label and put the quantity (if I’m at Kroger). I will earn a total of $2.50 back in cash for this purchase alone. Let’s just say the Fage yogurt was also on sale, and I had a coupon for a free one. Well, I am barely going to have paid anything for the yogurt when it’s said and done. I have even had situations where I was nearly PAID to buy an item, thanks to Ibotta, my other apps and coupons.

There is also a “pay with Ibotta” option on this app that you may want to take advantage of as well.

Redeeming your earnings: Ibotta is a cash back app, in which you can transfer your funds to Paypal when you have earned $20 back, and then directly into your account. Yes, you will need a Paypal account for cash back if you don’t already have one. Ibotta also now offers a broad array of digital gift cards if you would rather earn back in that way instead. Everything from restaurants to retail stores to airlines gift cards are an option: Whatever your heart desires!

Tips: I always tell new Ibotta users to never buy things they wouldn’t normally buy unless it’s something they really want to try. Also, keep brand names in mind. Maybe you can save $0.35 back on Ibotta, but maybe the generic item is still cheaper. Just stick with the generic then, unless of course you much prefer the brand of that particular item. Make sense? Another tip? Always check the “any” section even if you’re just going into the store to buy one generic brand. Sometimes they will offer $0.10 back on any brand of bread, any brand of chicken breast, etc. Some grocery trips you may only earn back $0.10 cents or nothing at all, but it’s all about shopping smart (and not buying things just because they are on there). If you start buying items just because they are on Ibotta, your intention to save might end up turning into increased spending. If you don’t much time to browse Ibotta, always check the “any,” “new offers,” and the “what’s hot” categories at the least.

Some months will be better than others on Ibotta. I have those months I earn $40 back, while other months it may look more like $4. It all depends on if they are featuring the items I tend to buy or not. Their cash back opportunities change constantly, so check often.

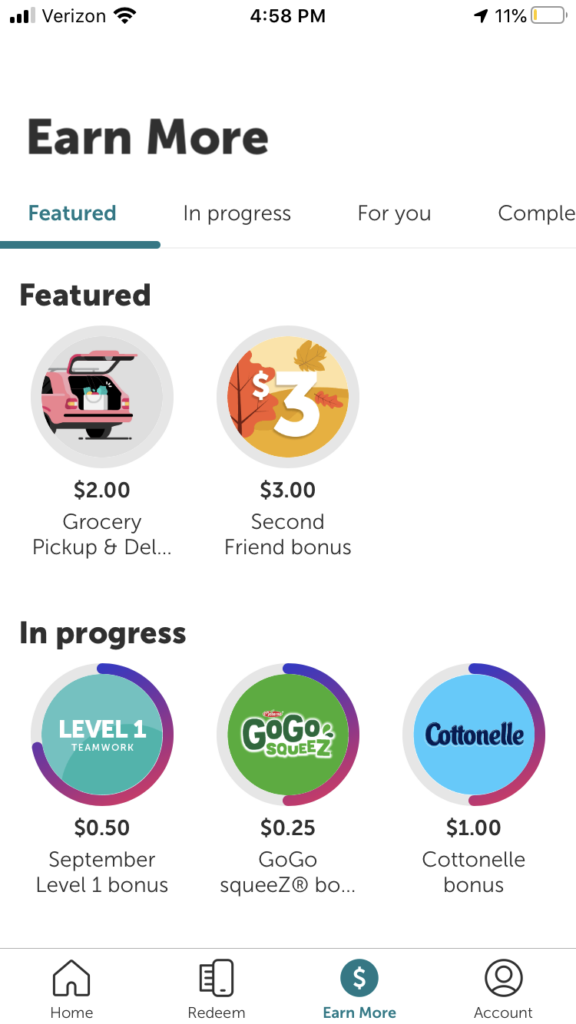

Other ways to earn cash on Ibotta: Ibotta also has a great referral program, which also gets your cash back stacking up even quicker. The referral incentives change all the time, but there are always opportunities to earn cash if your friends use your code to sign up for their account. It may be $5, or it may be more. If you feel inclined to help my earnings AND yours, here is my referral code you will want to enter: udlflrln

Ibotta also features a ton of bonuses: (IE – redeem 12 offers before such and such date and receive an extra $3 back in cash). They tend to run a lot of extra cash opportunities around holidays and special occasions. Another example of a bonus could be, “Buy 2 Cottonelle products to earn an extra $1 back.” As long as you appropriately scanned the item, Ibotta will detect and credit you with your bonuses automatically.

Again, to begin earning your cash back, sign up under my code of udlflrln.

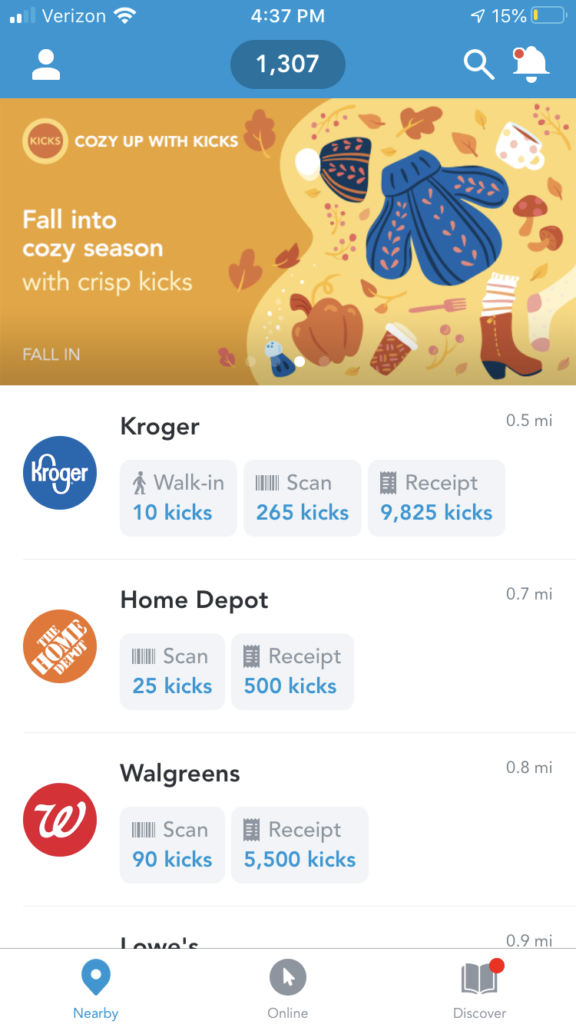

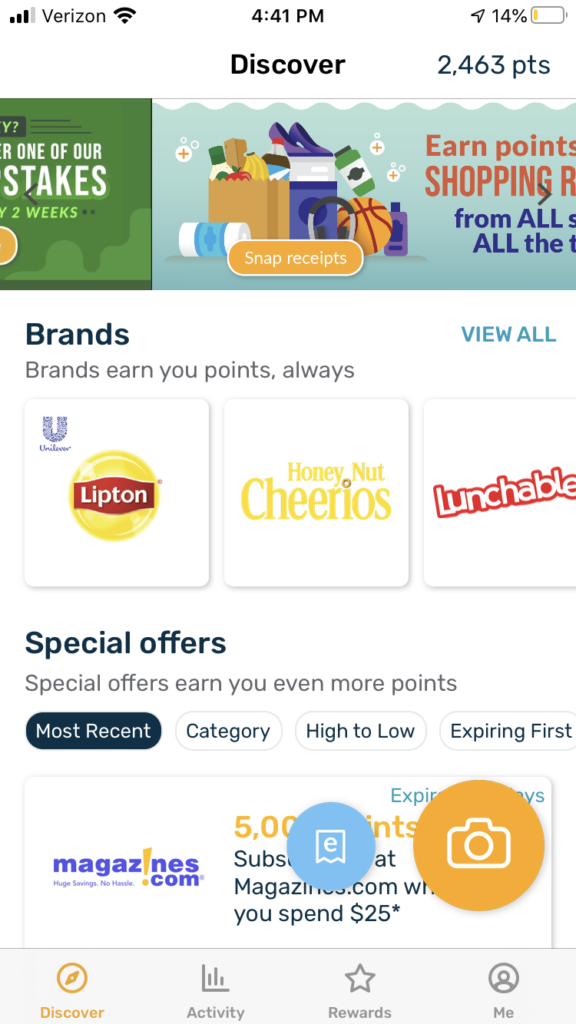

2. Shopkicks: While Ibotta has resulted in the most cash back for me, Shopkicks is a not too far distant second. I would also consider Shopkicks to be an enjoyable app. (though you somewhat have to work for it).

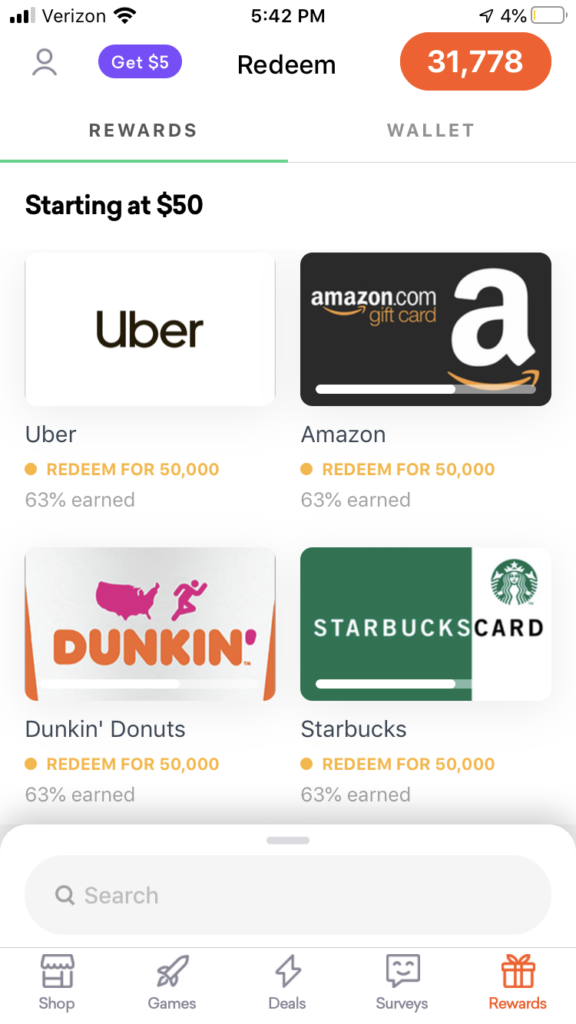

Description: On Shopkicks, you earn points towards various gift cards for a variety of reasons – from Outback Steakhouse to Sephora, you can enjoy gift cards all thanks to this app.

How to earn points? 1. You can earn points towards a gift card simply for walking into a store. (IE – if I am going to walk into Kroger, I turn on the app. click on the icon of the person “walking” and my phone will recognize I am in Kroger. Boom, there is 10 points. On certain days, some stores offer 100 or even 250 kicks for simply walking into a store).

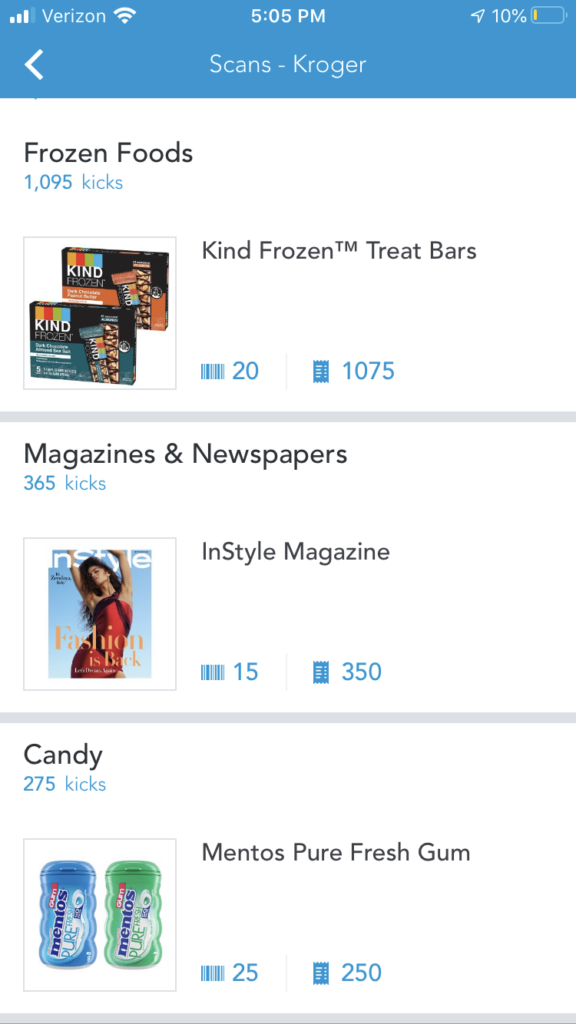

You can also earn points for simply scanning items that are on each store’s featured list. My sister and I enjoy walking around stores and scanning items (especially if they’re on the way) during big grocery shopping trips. We think of it as another fun way to get exercise. For instance, after you’ve earned 10 points for simply walking into Kroger, your scans section might also show that you can earn 40 points for simply scanning a bag of Seattle’s Best Coffee or 75 points for scanning a pack of Quilted Northern toilet paper.

3. Another huge way to earn points on shopkick is to actually buy some of their featured items. Any item you scan probably also offers points back if you purchase that item. For instance, I might scan the Quilted Northern toilet paper that is already featured in their sale that week, use a coupon for it, scan it for points on Shopkicks….AND then be able to take a picture of my receipt for an additional 250 points simply because I purchased the item. I may even find that Ibotta offers cash back on the same item! Another way to earn points is by linking your card to certain stores and earning points for each dollar spent (I don’t really do this one). Lastly, you can even earn points simply by going to their “discover” section and watching little random advertising videos…..because, why not?

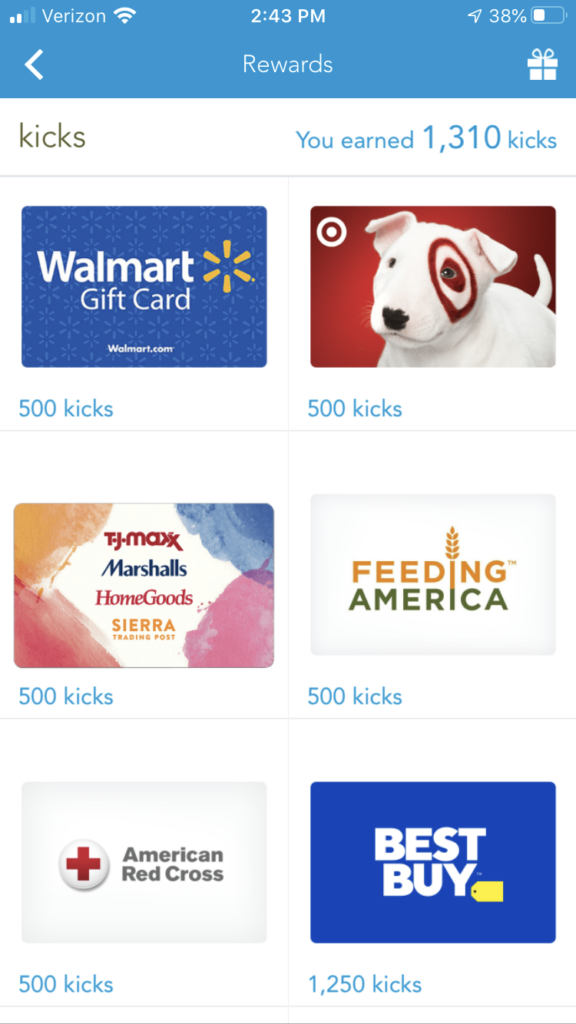

Redeeming your points: On Shopkicks, you choose the gift card you want to work towards (and you can change it at any time): 1,250 kicks = $5 gift card, 2,500 kicks = $10, 6,250 kicks = $25 and 12,500 kicks = $50. You can set your goal as low or as high as you like for whatever you are wanting. If you just want $5 to Starbucks, great – it won’t take you long at all. If you want $50 to Lowe’s, great again! Just be willing to work for it a little bit (but it’s fun work).

On Shopkicks in just 2 years, I have earned a total of 11 gift cards (technically 12, if I’d like to to cash in my current points for $5). I particularly enjoy redeeming their Sephora gift cards, because it’s a way to get cool makeup I am normally too cheap to buy. When I come home with Sephora bags, I can brag to my husband that Shopkicks funded my trip. All gift cards are received electronically. (Be prepared to manually punch in the gift card numbers at the store).

Tips: Again, do not trick yourself into buying items you wouldn’t normally buy just to earn points. The key is to save money – not to spend more or to do anything counterproductive. Sometimes your app. will even recognize you are in a parking lot and award you points without ever even walking into the store. However, this is usually only true of 10 pointers. If Marshall’s is offering you 250 points to walk inside, you probably need to walk inside. Unfortunately, sometimes this app. can be a bit glitchy for walk-ins. They give you an opportunity to report the error, but I’m not convinced it always works.

With all of that said, Shopkicks also has a super cool referral program. If you sign up under me and simply walk into a store, scan or buy something on the app within 7 days, we will both earn 250 kicks! My code is MALL366184.

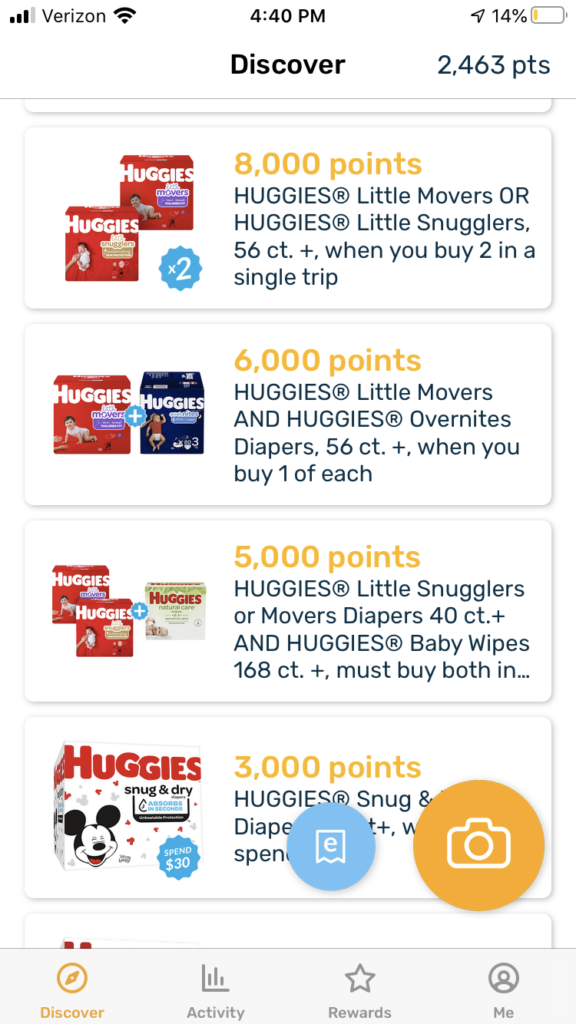

3. Fetch Rewards: I feel like this app is a bit underrated. I have already earned 8 gift cards on this one in a little over a year, but this is one may take a little longer to stack up for you, depending on where you shop and how you shop. I also have at times decided I wanted to redeem an Amazon gift card at just $3 of earnings. This app particularly loves certain brand names, but if you buy all generics, this does not at all mean that you won’t be able to earn gift cards. You just may average 25 points on a receipt vs. 1,000.

Description: The main thing you need to do on this app. is to scan your grocery and gas station receipts for a minimum of 25 points each. Recently, Fetch has even started giving 5 points for restaurant receipts, along with other non-grocer stores. If you buy any of their “featured items,” you will earn back more points than the standard 5 or 25. For instance, if you follow the directions on these diapers pictured above, you can earn thousands of points from your receipt. Now, it’s important to note: There ARE times you may have to hit “correct my receipt,” and give a little more information. I have had those times that Fetch didn’t detect a featured item on my receipt. However, when I notify them, they always take care of it. It tends to pick up on my smaller earnings, but my bigger ones, I sometimes have to let them know their app. didn’t give me credit. Can that be a pain? Yes, but again, I’m working towards those gift cards.

What’s great about this app. is the double earnings you can get back from it. Let’s just say that you purchased the Dove body wash off of their special offers for a total of 1,000 points – it just may be that Kroger had it on sale for $4.99 that week, plus offered a $1 off digital coupon, PLUS Ibotta offered $0.75 back, PLUS shopkicks gave you 25 points for scanning and 250 for buying it. Yes, sometimes you can really luck out just like that!

I have really lucked out at times….and I LOVE it. Similar to Shopkicks, yet of course different, points add up to gift card redemptions on this app (1,000 points = $1………3,000 points = $3…….$5 points = $5 all the way to 50,000 points = $50.00). Again, you can cash in your points whenever you want for yet another electronic gift card.

Tips: I prefer to use these electronic gift cards on online purchases, as this one can be a pain to use in a store. While Sephora never seems confused by my Shopkick redemptions, I feel like this lesser known app can confuse some cashiers. Maybe it is just my luck, but I prefer to redeem on this app. for online purchases with Target, Amazon or something like that. I guess nowadays you can shop at any of these places online. I don’t want to discourage you against using this at any restaurants or stores, as it may be just fine for you. I just wanted to make you aware, not everyone will know about this app.

Again, this app. offers a super cool referral program. If you use my code, we will both get 2,000 points when you scan your first receipt. My code is T8BWA.

Cool side note: This app. literally tracks your spending for the year at each store. It compares month-to-month and year to year. This COULD be a helpful budgeting/record-keeping tool if you’d like it to be. Just click on “activity” to see all of the details.

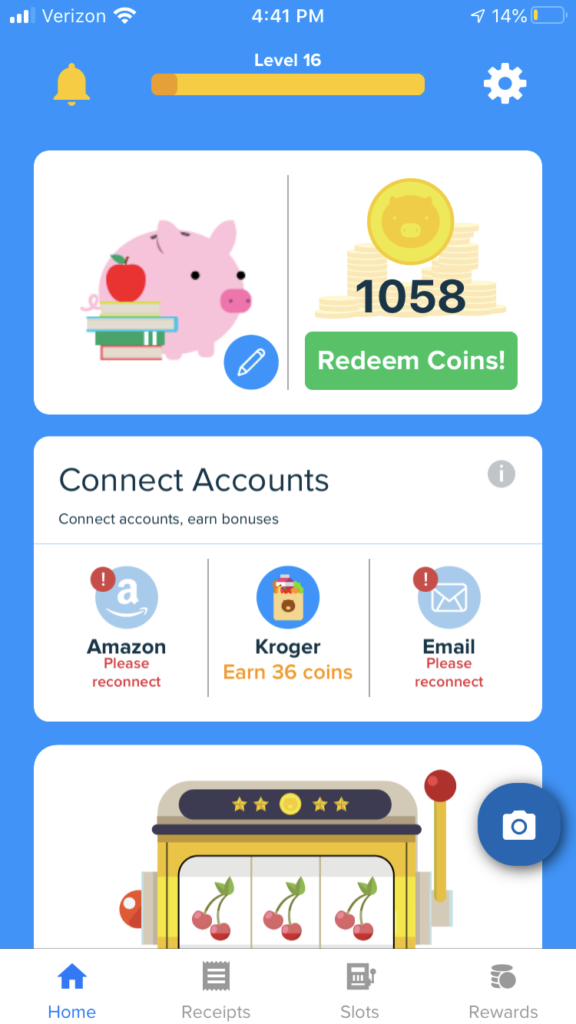

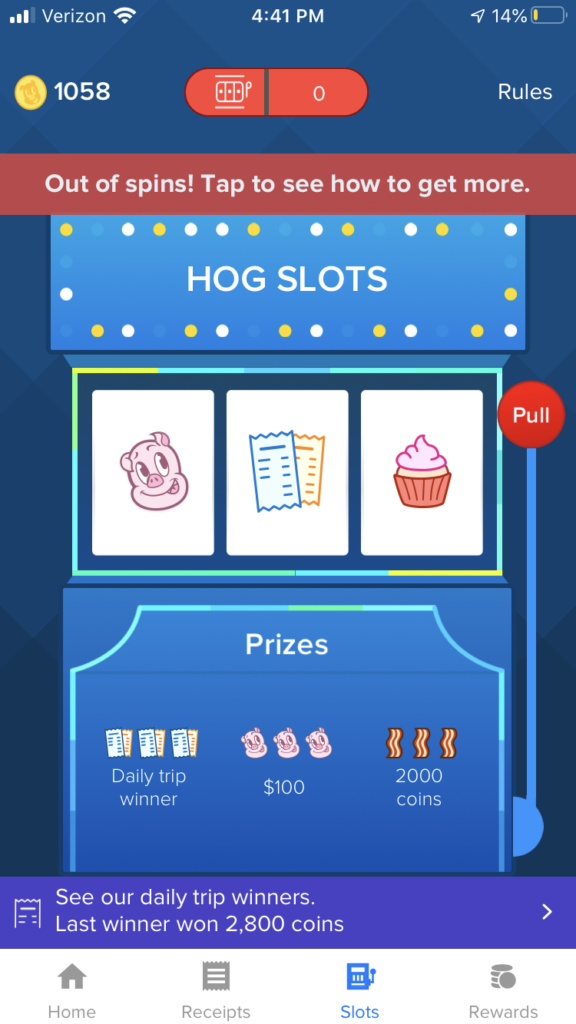

4. Receipt Hog: So, I’m going to tell you from the get-go, this app is my slowest for earnings. A lot of impatient people may not stick around on it long – yet I stay, because why not? I do earn money back and it accepts nearly EVERY SINGLE receipt no matter where it is from. On this app, you also earn “points” AKA “coins” for either a Visa or Amazon gift card, or you can earn money that can be sent to your Paypal account.

Description: Basically you just simply scan your receipt. It doesn’t matter if it’s a fast food restaurant, a clothing store or a gas station, receipt hog is happy to accept and happy to give you something……even if not very much. The higher the grocery bill, the more coins you will get. They accept more receipts than most apps. While this app is slow to stack, it is entertaining to me. First of all, it features a cute little pig that appears in different costumes for different times of the year….AND a super fun slot machine where you do have a chance to strike it “big.” That possibility of my receipt being drawn (it has happened before) always keeps me coming back and submitting receipts.

So let’s break this down: If you shop at a pet store, you will get both “coins” and a sweepstake entry for simply scanning your receipt. For instance, when I buy my dog’s food at PetSmart, and I will get awarded around 15 coins and a sweepstakes entry for doing so. If you go to a clothing or electronic store, you get to play their slot machine! This part is so fun, and makes this among the most entertaining of the savings apps (at least for me). Though many times, your slot is unsuccessful or your awards are not much more than 2, 5 or 10 coins, it is still something and still fun. It’s not like it’s some big time waster. Big winners can earn a TON of coins, and even $100 (though I’ve never been that person just yet) – there are winners all the time. In general, you will either get coins and/or a sweepstakes entry for almost anything. The more entries you have, the bigger your chances of course. Like I said, this isn’t a huge earnings app. most of the time, but fun, and super easy. It literally takes 2 seconds to scan your receipt.

Tips: If you go to the rewards section, sometimes they will also feature surveys you can take for additional coins. You can also get additional points for connecting your Amazon or e-mail to this account.

This app. does not offer a referral program, but again, too fun to pass up!

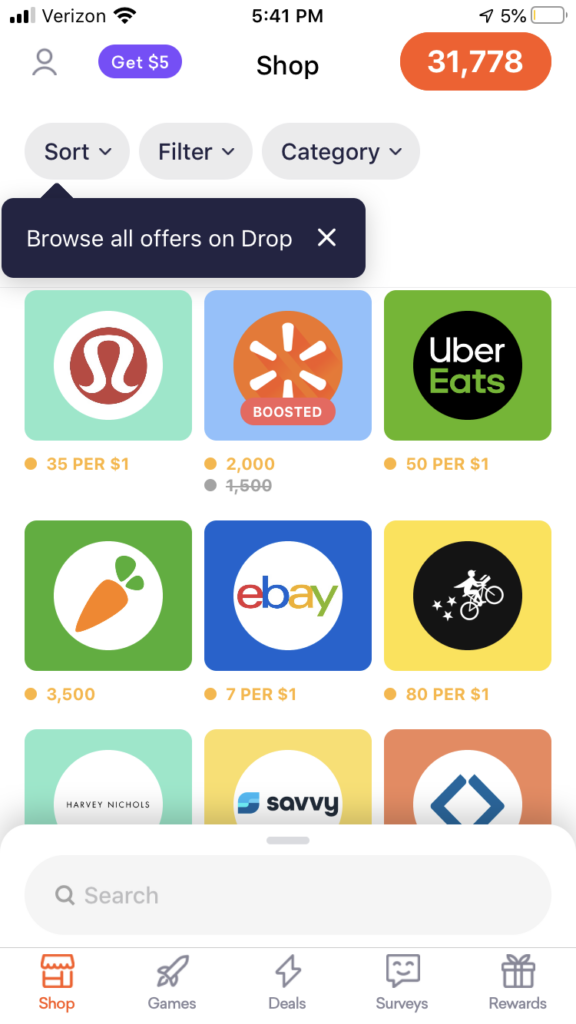

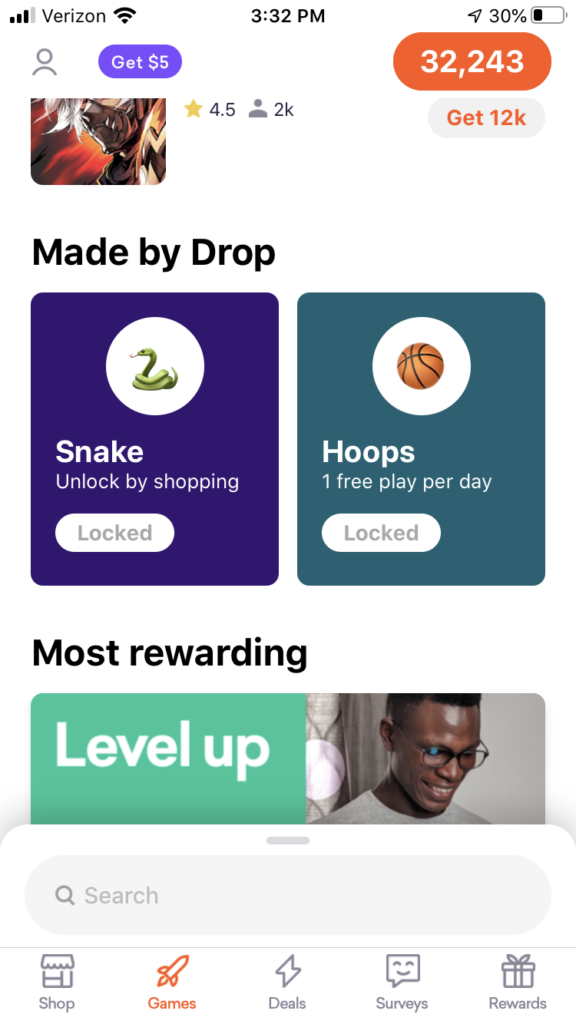

5. Drop: This app. is yet another fascination of mine, thanks to my little sister (my fellow saver). We are carbon copies of one another when it comes to savings (and we are not making any apologies for it either). Because I joined this app, we both received 5,000 points from the get-go, which is equivalent to $5 for both of us.

Description: There really isn’t a ton to say about this one, because once you set up your account, you do little to NO work (unless of course you want to put in a little). This app. can be as little or as much as you’d like to make of it. Now, things have changed with this app. since I first downloaded on it. I don’t want to tell you wrong, but I cannot see everything without setting up a new account. I also cannot find the specifics online. However, I believe the new process goes like this: You simply link your card to this app and choose 2 retailers or restaurants that you’d like to earn points at. (1,000 points = $1, just like on Fetch). As long as you use your card to make purchases at these businesses, it does the work for you. If you don’t want to do much more than that, you are still on your way to earning some good points.

You will want to choose 2 of the places on their list that you are likely to spend the most money at. You can browse their offers to start earning points as well, but at the very least, any time you buy something at one of those 2 places and use your card, you will automatically get points towards a gift card. (IE – if you choose Starbucks as one of your choices and then go order a coffee, you will automatically be awarded points when you use your card there. You don’t need to scan anything. It may take a few days to see your points in your account, but rest assured, they should arrive). You don’t have to do anything, except swipe the linked card. Now, there are also a TON of offers (outside of the 2 businesses you choose) available, if you’d like to advantage of them. If you shop through the app. at Wal-Mart for example, there just may be a current opportunity to earn 60 points back per $1 spent. Click on the “Shop” tab to see what the current offers are.

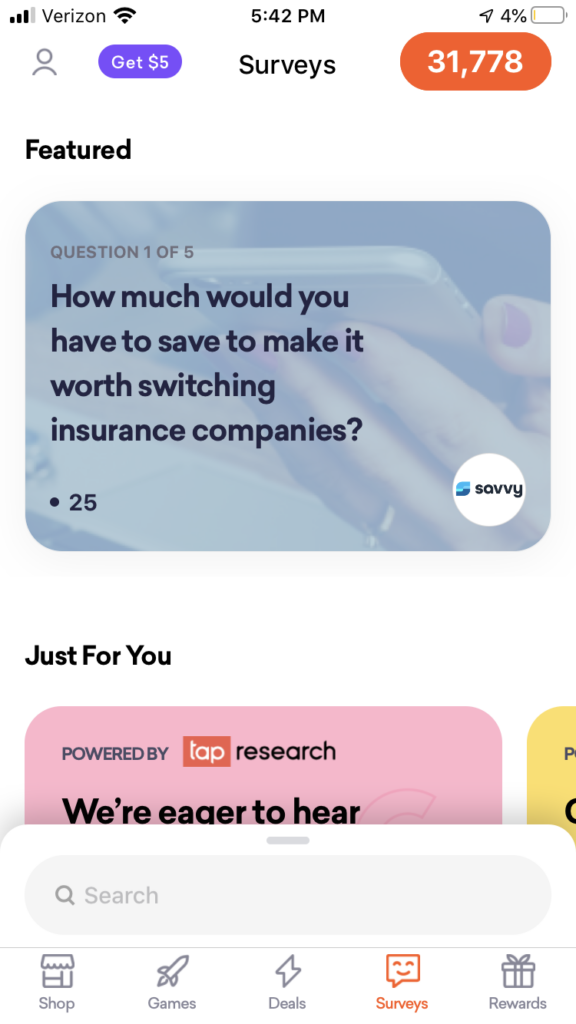

Other ways to earn points: They also feature a fun game called, “supercharge,” where you can earn additional points. The icon is a snake, so you have to stay on the lookout for it. It stays locked until you earn points shopping. You also get to play “hoops,” among other little fun games. As I’m writing this, I literally just stopped for a game of hoops. You get one free play a day. I earn around 50 points each time I play. This app. kind of has a Receipt Hog vibe to it. It can be entertaining for sure. They also offer a ton of surveys for points if you feel comfortable answering the questions on there.

Though it has taken me a little while to stack up, it’s such a low-maintenance app. As you can see, I have almost $32 stacked up from very minimal effort.

As mentioned, this also contains a great referral program. If you use my code, we will both earn $5: 1fcto

Tips: While I will admit I haven’t had the energy to learn EVERYTHING on this app, I would encourage you to study it. There is A LOT on there. While I am not the master of this app., I do want to encourage you to really think it through on which of the businesses choices you are likely to spend the most money at BEFORE you choose them. Apparently, you cannot change them once you select them, so choose wisely. Looking back, I wish I would’ve known this. Still, I cannot complain about this little gem of an app!

6. Coinout: This one is so very easy.

Description: It is a concept that is pretty similar to Fetch, though it awards cents back to you rather than “points.” It may take a minute for your earnings to stack up, as you typically earn anywhere from $0.1 – $0.3 cents back on each receipt, but I’ve earned up to $0.13 back on some. I don’t think they’ve ever rejected a single receipt of mine. All I’ve been doing is scanning receipts, so I cannot complain. However, there are A LOT of other opportunities on there which I’m not taking advantage of. I will admit, I need to do some more exploring beyond scanning my receipts. They feature a great deal of businesses who offer cash back. They even offer cash back on certain groceries. Whether you’re purchasing in store or online, you can earn cash back. I encourage you to check deeper into this app.

Tips: As I said, study this app. I think you will be impressed enough. Also, take clear pictures. Beware: They inform you that if you send a duplicate receipt, you will lose your account – so be sure to never accidently scan a receipt twice (happens to the best of us). Lastly, realize your gift card or earnings do not happen automatically. You will need to wait a few business days (up to 10) for them to approve it.

Note: I recently earned a $10 Amazon gift card on there and am well on my way to receiving another gift card. However, I am seeing now it takes a minimum of $20 to transfer your earnings to Paypal.

Again, they have a cool little referral program. Their incentives change, so though I cannot tell you what you will earn, it will be something: My link: https://coinout.com/referrals/new?r=Z76F2ND

7. SavingStar: Yet another way to earn cash by simply buying groceries you may normally buy.

Description: I think of this one as a much smaller, slower stacking up Ibotta, minus the bonuses. Yet, I still see them as worth it, as I did earn $20 on there in a fairly short time due to some bulk diaper buying. One way they do differ from Ibotta is that they have a lot more offers that are a bulk requirement. For example, at this moment, if you buy $25 worth of Kellogg’s cereal, you can earn $5 back. You can buy this cereal in one trip or many.

Tips: You will want to be aware that if you are working towards a bulk rebate that you must complete it before the expiration dates on there. If not, you will lose what you worked toward, which has happened to me before. This does make this app. a harder one in some ways. However, earning the $15 back in diapers I did that one time really did make it stack up quickly. Also, they do have here and there $1 – $3 back offers on single items. All in all, I do not consider this a high maintenance app. While it’s probably not going to become my biggest earner, I do check this one before I go to the store. Though I haven’t explored it, they are now also partnered with coupons.com, which may interest some of you. So yeah, I see this app. as worth having.

Referral program? Not that I know of, but maybe I’m missing something, or maybe that will change.

How to redeem: Once you’ve earned a total of $20 back, you can redeem and send to Paypal.

Other apps worth mentioning: I’m not as well-versed in this one, but I do think you should know about it: Rakuten (formerly known as Ebates). I have this one downloaded on my phone, and know it’s been around a long time. I understand the concept of it, and know people earn back a lot on here. The main reason I haven’t gotten too much into it is because I can do a lot of what I’d do on there on Ibotta or another app. It just feels easiest to let my points build on another app. that I more frequently use. Still, I do keep this one, and have heard others say many great things about it. I’m definitely not counting it out, as it is certainly legitimate and credible. Maybe I’m just already balancing too much? (Imagine that).

I also should mention Checkout51 (which is basically the same concept as Ibotta). However, Checkout51 doesn’t offer anything close to what Ibotta does in terms of variety, last time I looked. They also tend to “run out” of offers. I decided I didn’t really want to mess with this one any longer and deleted it. However, you may want to check it out. Maybe it has improved? Maybe I should look again. I also have Receipt Pal on my phone. There are some ongoing issues going on with confirming my e-mail, but I do know you can scan receipts and earn points, which turn into cash. I suggest looking into that one as well.

Now, with all of that said, I have earned back almost $800 between all of these apps. in 2 years. Some of my earnings ended up being straight cash back that I transferred to Paypal, and then to my bank account. Other times, I earned a gift card.

Either way, THIS money has helped in a variety of ways: I’ve bought little things off Amazon I wanted. My app earnings even once funded a nice anniversary dinner, among many other little luxuries. Sometimes I just decide our bank account could use a little boost before pay day, so I’ll transfer $20-$40 over from Ibotta at that time. For the longest time, I got pretty much ALL of my makeup from Sephora for free simply because of my Shopkick app.

Maybe you want these apps to be your excuse for purchasing Starbucks coffee. After all, your husband cannot complain if it was free, right? The possibilities are endless, and I suppose we can all be motivated by something different.

Now, Ibotta is my winner in terms of what I’ve earned back. It has given me half of all of my earnings out of all of these apps. So, if you can only choose ONE, I suggest Ibotta. However, every single app I have given you is worth the time, in my opinion. If it’s simply scanning a receipt, why not? And on Drop, you don’t even have to do anything except link your card for at least TWO companies to earn some points over time. Yes, apps like Receipt Hog take awhile to stack up, but oh well. If you don’t put much work into it, what’s the harm? Just a couple months ago, I got my first reward on Receipt Hog. Yes, it took a long time to build that cash, so I decided to get something fun and meaningful with it: I bought my mom, sister and self an essential oil/stress relief bracelet off of Amazon. I also got Clara a personalized card book for her 1st birthday, as a special keepsake she can always have. Every single one of us are enjoying our fun little Receipt Hog reward.

The bottom line: For a majority of these apps, it only takes a second to scan the receipt. I have a system. I take each receipt and do what I can with it on each app…..and then I move on to the next receipt.

Whew okay…..I got descriptive on all of this, but I know how overwhelming all of this can feel at first. It takes a minute to really learn all these apps, and I still cannot say I’m all of the way there. Do not get overwhelmed by this blog post, simply because of all of the words. Yes, I went into great detail, BUT none of these apps are overly complicated to get started on. I just wanted to give you all the ins and outs, tips and my personal observations so that you can have the best experience possible on each of them.

So really….I just wanted to write the type of blog that I tend to find useful in my own life. There are also a lot of great YouTube videos out there that also explain these apps in great detail, if you are more of a video person.

Final Confession: Yes. Sometimes I feel like I’m juggling apps while walking into a store, yes. Sometimes I’m looking at deals on Ibotta, while my sister is handing me an item to scan for Shopkicks….and sometimes I’m trying to remember if the item I’m hoping to get cash back for on Ibotta is also featured for points on Fetch. Sometimes I forget to scan a receipt. Sometimes I get a little frazzled. Sometimes I am also trying to look at my Kroger digital coupons and my paper ones at the same time, but guess what friends? It is totally doable…..and super fun! I will admit I have been slacking on Shopkicks during all of this COVID chaos, but I still love it! I can still make it out of a huge grocery trip in about an hour. I can do most of my app work in the comfort of my own home.

I also know that I didn’t even come close to listing all of the savings apps out there – these are just my go-to’s. I know I’m late to the party with Ebates, among others….and would love to hear some of your favorites too! (please share them in the comment section below). I never get tired of learning about new ways to save!

If you enjoyed this post, please let me know that as well. As I said, this is only scratching the surface on my savings. I am totally open to doing more savings posts in the future! This isn’t even counting my coupons and other savings avenues. The future post possibilities are endless!

Sound off below if these savings posts are something you would like to see more of!

Until then…Happy Savings, friends!